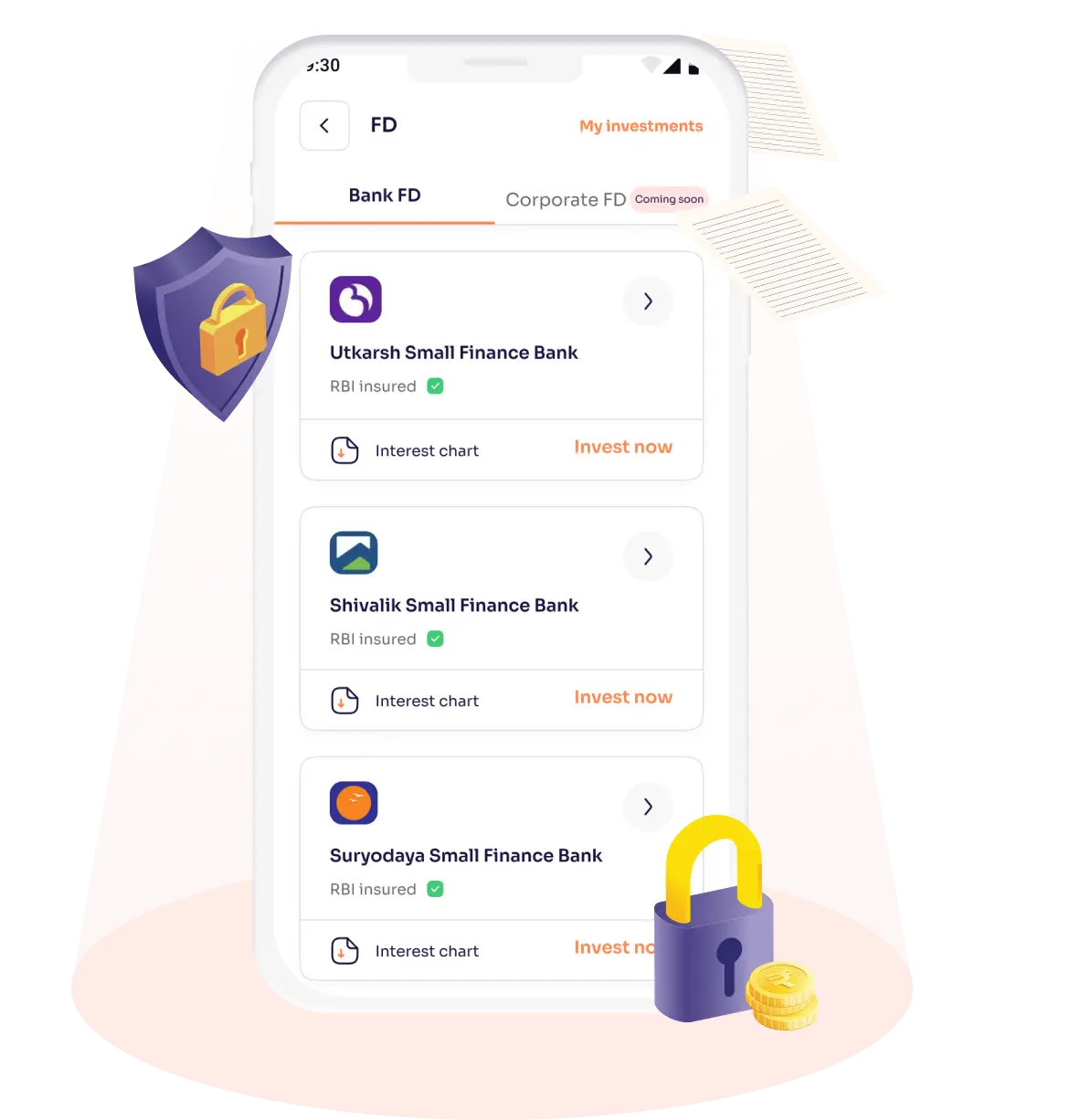

Park your savings at a fixed interest rate, one fixed deposit at a time

Safeguard a part of your portfolio against market fluctuations

Manage your deposits online and reinvest conveniently

Compare interest rates across banks and NBFCs

Have an enquiry? Get in touch with our 24/7 support

Guaranteed returns Earn fixed returns for any length of time you choose to stay invested

Guaranteed returns Earn fixed returns for any length of time you choose to stay invested

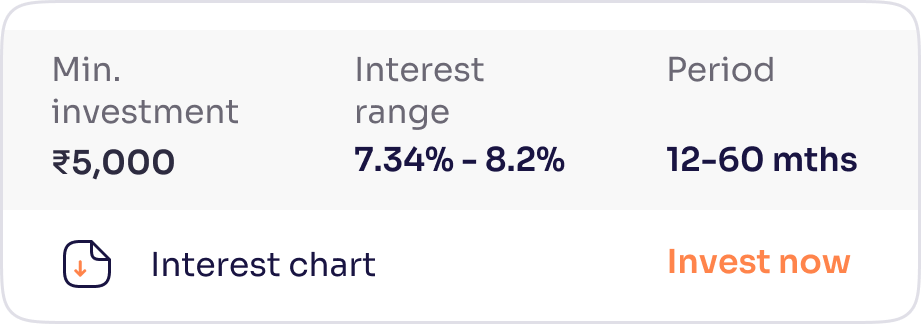

Flexible tenure Choose the lock-in period according to your goals, be it one year or five.

Flexible tenure Choose the lock-in period according to your goals, be it one year or five.

Liquidity Exercise the freedom to withdraw your funds, anytime you need.

Liquidity Exercise the freedom to withdraw your funds, anytime you need.

Senior citizen benefit Avail an additional interest rate for investors older than 60 years.

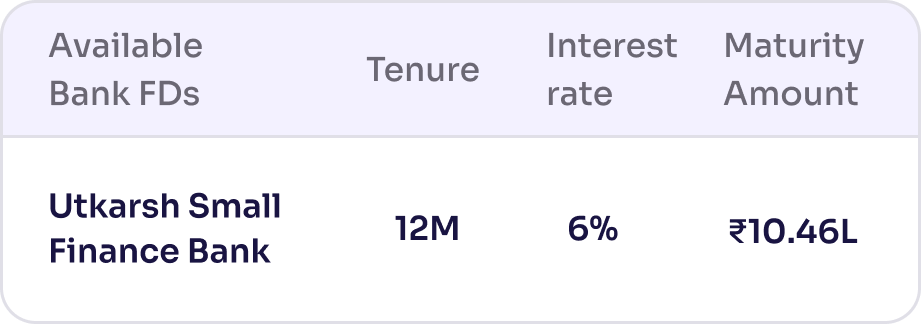

Senior citizen benefit Avail an additional interest rate for investors older than 60 years. | Available Bank FDs | Tenure | Interest Rate | Maturity Amount |

There are no FDs available, try a different combination.

There are no FDs available, try a different combination.  Approx. Payout amount

Approx. Payout amountStart your investment journey online in just 3 steps

Create your account

Open your account in minutes with your Aadhaar & PAN

Find the right FD

Explore and choose deposits based on tenure and interest rates

Start Investing

Add funds through several ways and protect your money

We recommend you to use the number linked to your Aadhar card for a seamless investment experience.

Yes, you can re-invest the final maturity amount of your Fixed Deposit (FD) by choosing the “Re-invest” option when finalizing the maturity instructions for the FD. The principal amount as well as the interest earned on it will be re-invested.

Most banks and NBFCs offer an additional interest rate over regular fixed deposit interest rates for senior citizens.

Here’s how our different bank partners offer additional interest rates to senior citizens.

It generally takes two working days for the withdrawn amount to be reflected in the connected bank account.

Deposit Insurance and Credit Guarantee Corporation (DICGC) is an RBI subsidiary that provides insurance cover for deposits and guarantees credit facilities. Currently, the DICGC coverage is ₹5 lakh per account (separately for accounts in separate banks) . In case the bank goes under liquidation or loses its license, the bank account holders will receive up to the insured amount for that account.

The minimum deposit amount for all banks with Ventura is Rs. 1,000 except North East SF Bank, for which it is Rs. 5,000. The maximum amount is Rs. 10,00,000.