Identify the right IPOs to invest in with our research notes

No Upcoming IPOs now.

No Closed IPOs now.

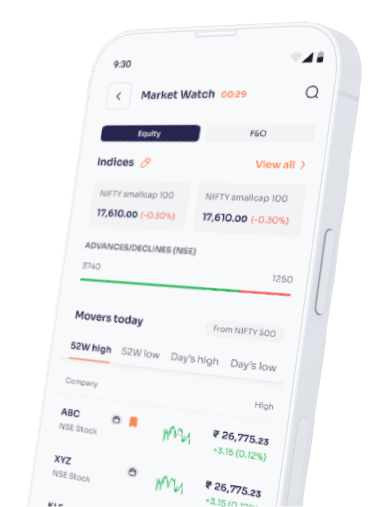

Investing in IPOs online has never been easier. Get started in 3 simple steps

Create your account

Open your account instantly with your Aadhaar & PAN.

Choose an IPO

Find all the information you need about the IPO from a single platform.

Apply in one click

Confirm your bid quantity and place your order.

An IPO or Initial Public Offering is the issuance of shares by a company for public investment. When launching an IPO, companies announce the total number of shares they intend to issue and the price band/minimum no. of shares one must subscribe to. Once the IPO is launched & subscribed to, these shares are listed on the stock exchange(s) and may be traded regularly.

Launching an IPO transfers the ownership of a company which may have been private from its erstwhile owners/investors to the general public (those who choose to subscribe to the IPO and are allotted shares).

Before a company goes public its ownership may be confined to an organisation/set of investors who raised its initial capital. This brings about a restriction on how much money may be utilised by the company without opting for loans. Issuing an IPO allows the company to accept investment from the public in general in exchange for a share of ownership. This not only pumps in additional capital but also dilutes the company’s liability.

Every IPO announcement is coupled with details on when the IPO will be open for subscription and the price band/minimum shares (lots) one must subscribe to. On the pre-specified dates you can apply for the IPO and approve a mandate for the required investment amount. If your subscription is approved the corresponding amount is deducted and the shares are deposited.

Our services for IPO application will be live shortly. You may drop your coordinates here to ensure that you are intimated as soon as they launch.

When picking an IPO consider the following factors:

Your investment objective: Investing in an IPO may be done from a long-term objective of getting into the growth of a company as early as possible and staying invested, or from a short-term objective of applying for an IPO at lower prices and selling the shares at a profit after listing.

The company’s core business and management: If the company belongs to a sunrise sector and is run by an experienced management team, it might capitalise on growth opportunities. You should carefully evaluate the company financials along with its growth rate in the last few years. Usually, high growth companies having robust financials attract long-term investors.

How aggressively the IPO is priced: While this may seem slightly complicated for first-time investors, as a rule of thumb you may want to compare the growth rate and valuations of the company with that of the industry leader in the listed space to gauge the attractiveness of the IPO.

Refer to its Red Herring Prospectus: A Red Herring Prospectus or RHP contains comprehensive information about a company planning to raise money via IPO. Every company planning for an IPO must file RHPs at least three days prior to the launch of an offer, in accordance with section 32 of the Companies Act 2013 and SEBI’s Issue of Capital and Disclosure Requirements (ICDR). This document contains multiple sections covering information pertaining to the offer, risk factors, company specific information, the company’s financial, legal & other material information etc.

For further assistance/information you may also check out Ventura’s research notes that are provided with every listed IPO.

IPOs can be an avenue for both long-term & short-term growth of funds. In terms of long-term growth it is a way to make an early investment in companies. Assuming the company has high growth potential its future stock value will most likely be far greater than the IPO price. For short-term gains one may analyse the market for upcoming IPOs that show high promise/are offered by companies of repute, subscribe to them and assuming their listing at a profit sell them off at the listing price.